The CHAPS system is usually open from 6am to 6pm, Monday to Friday (excluding bank or public holidays in England and Wales).

What is CHAPS?

CHAPS is one of the largest high-value payment systems in the world, providing efficient, settlement risk-free and irrevocable payments. There are over 35 direct participants and several thousand financial institutions that make CHAPS payments through one of the direct participants.

Who uses CHAPS?

Direct participants in CHAPS include the traditional high-street banks and a number of international and custody banks. Many more financial institutions access the system indirectly and make their payments via direct participants. This is known as agency or correspondent banking.

CHAPS payments have several main uses:

- Financial institutions and some of the largest businesses use CHAPS to settle money market and foreign exchange transactions

- Corporates use CHAPS for high value and time-sensitive payments such as to suppliers or for payment of taxes

- CHAPS is commonly used by solicitors and conveyancers to complete housing and other property transactions

- Individuals may use CHAPS to buy high-value items such as a car or pay a deposit for a house

CHAPS Direct Participants

Banco Santander, S.A. (London branch)

Bank of America N.A. (London branch)

Bank of China Limited (London branch)

Bank of England

Bank of New York Mellon (London branch)

Bank of Scotland plc (part of the Lloyds Banking Group)

Barclays International (a trading name of Barclays Bank plc, part of the Barclays Group)

Barclays UK (a trading name of Barclays Bank UK plc, part of the Barclays Group)

BNP Paribas SA (London branch)

Citibank N.A. (London branch)

ClearBank Limited

CLS Bank International (an Edge Act Bank based in New York)

Clydesdale (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

Danske Bank (a trading name of Northern Bank Limited, part of the Danske Bank Group)

Deutsche Bank AG (London branch)

Elavon Financial Services DAC (UK branch)

Euroclear Bank SA/NV (Brussels Head Office)

Fnality UK Limited

Goldman Sachs Bank USA (London branch)

Handelsbanken plc (a UK subsidiary of Svenska Handelsbanken AB)

HSBC Bank plc (part of the HSBC Group)

HSBC UK Bank plc (part of the HSBC Group)

iFAST Global Bank Limited

ING Bank N.V. (Amsterdam Head Office)

J.P. Morgan Chase Bank N.A. (London branch)

LCH Limited

Lloyds Bank plc (part of the Lloyds Banking Group)

National Westminster Bank plc (part of the NatWest Group)

Northern Trust Company (London branch)

Royal Bank of Scotland plc (part of the NatWest Group)

Santander UK plc (part of the Banco Santander Group)

Societe Generale (Paris Head Office)

Standard Chartered Bank plc

State Street Bank and Trust Company (London branch)

The Co-operative Bank plc

TSB Bank plc

UBS AG (London branch)

Virgin Money (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group)

How does CHAPS work?

Payment obligations between direct participants are settled individually on a gross basis in RTGS on the same day that they are submitted. The transfer of funds is irrevocable between the direct participants.

Operating hours: The CHAPS system opens at 6am each working day. Participants must be open to receive by 8am and must send by 10am. CHAPS closes at 6pm for bank-to-bank payments. Customer payments must be submitted by 5.40pm.

What are the benefits of CHAPS payments?

Direct access to CHAPS supports secure and efficient provision of high value, same day payments from payment service providers to their customers. There is no minimum or maximum payment limit.

High level of operational resilience based on the Bank’s real-time gross settlement infrastructure and the SWIFT messaging network.

Settlement risk is eliminated between CHAPS direct participants, at the cost of an increased need for liquidity, making this model best suited to a high-value payment system with the largest potential systemic risk.

Requirements for Direct Access to CHAPS

To become and remain a CHAPS direct participant an organisation must meet certain criteria.

An organisation must:

- Hold an account at the Bank which may be used to settle payment obligations. Account access criteria are set out in the Bank’s Settlement Account Policy

- Be a participant within the definition set out in the Financial Markets and Insolvency Regulations 1999

- If domiciled outside England and Wales, provide information about company status and settlement finality through a legal opinion

- Comply with technical and operational requirements, including those set out in the CHAPS Reference Manual, on an ongoing basis

The Bank operates a ‘trust and verify’ approach. Direct Participants must self-attest to their compliance with the CHAPS rules and requirements, and declare instances of non-compliance. The Bank may also seek to verify certain areas.

Technical requirements include access to the SWIFT network compromising one or more BICs, use of SWIFT InterAct Copy, appropriate interfaces to connect to the SWIFT network and process messages. Other important components are access to an Enquiry Link facility provided by the Bank and the Extended Industry Sort Code Database which is supplied by VocaLink.

Gaining access to CHAPS

The number of CHAPS direct participants increased by over 50% between 2015 and 2020 reducing risks to financial stability. The Bank regularly reviews its access policies to support wider access, including to support a more innovative and competitive market in payments, subject to where we can safely do so without impairing financial stability.

In February 2024, the Bank published a discussion paper on reviewing access to RTGS accounts for settlement.

The Bank, as operator of CHAPS, and a number of other UK payment system operators have published information to help organisations consider whether direct or indirect access best suits their needs.

Direct access to CHAPS

The typical timeline for joining CHAPS is around twelve to eighteen months from an initial meeting. Applicants must demonstrate their ability to meet the eligibility criteria set out in the CHAPS Reference Manual and comply with the technical and operational requirements. This is through a self-attestation model as well as technical testing. Applicants are also expected to provide information on their business model and rationale for seeking direct access to the CHAPS payment system. The Bank undertakes a series of risk assessments based on this information, including ahead of allocating a joining date.

In January 2022, a refreshed version of the CHAPS Reference Manual took effect. This was the final step in a programme of work to enhance the CHAPS Reference Manual. The new version is simpler, reduces duplication, and seeks to reduce the burden on CHAPS Direct Participants while maintaining an appropriate level of risk management. We also introduced sections on security and outsourcing; the latter facilitating the potential for CHAPS Direct Participants to use cloud-based solutions for processing CHAPS payments.

The Bank is currently undertaking a major programme to renew the RTGS service including having adopted the ISO 20022 messaging standard for CHAPS from 19 June 2023; and a new core ledger and settlement engine planned for 2024. Each change requires technical preparation, including change freezes to the current RTGS infrastructure to safely deliver the necessary changes.

The renewed RTGS service has been built to support a substantial increase in the number of CHAPS direct participants – with a simpler and more proportionate joining process than previously. For example, testing will be streamlined for new joiners as well as existing CHAPS direct participants.

Given the changes underway, the number of slots available to join CHAPS is lower during the transition period to the renewed RTGS service. The next available joining date for CHAPS is likely to be in the first half of 2025. The earliest of these slots are likely to be allocated to a small number of organisations who have already engaged with us on future direct access to CHAPS. We continue to welcome expressions of interest for direct access to CHAPS from eligible organisations who want to understand the relevant rules and future technical requirements with a view to being ready to join in 2025, give the typical timeline for joining CHAPS is around twelve to eighteen months.

If you would like to know more about direct access to CHAPS please contact rtgschapsaccess@bankofengland.co.uk

Indirect access to CHAPS

For those interested in indirect access, Access to Payments includes a list of Indirect Access Providers and details of their offerings.

Cost of Direct Access to CHAPS

The cost of direct participation in CHAPS includes one-off set-up costs, such as the cost of developing the necessary hardware, software and processes to connect to CHAPS and establishing sufficient expertise amongst staff. They also involve a potentially significant level of ongoing cost, such as fees and other participation costs; opportunity costs of providing collateral or holding liquid assets; hardware and software maintenance; and higher staffing costs.

We charge CHAPS Scheme fees to Direct Participants with an annual participant charge and a per-item fee. We do not charge a joining fee but certain costs, such as external legal fees, may be recovered from Direct Participants.

Other costs that CHAPS Direct Participants can expect to incur are:

- VocaLink charges for status changes within the Extended Industry Sort Code Directory (EISCD)

- SWIFT tariff fees and charges for CHAPS payment and advice messages

- Regulatory fees, including from the Payment Systems Regulator

- Hardware and software costs such as a payments gateway or using the services of a technical aggregator

CHAPS payments for customers

Indirect participants access the CHAPS system through one of the Direct Participants based on a commercial and contractual arrangement. The Direct Participant makes and receives payments on behalf of indirect participants and other customers including business and individuals.

- Various organisations provide advice to help prevent fraud and implement security policies to help reduce the risk of successful cyber-threats. For issues with specific payments, users should contact their bank, building society or other payment service providers.

- On 7 June 2023, the Payment Systems Regulator published its final policy statement on Fighting Authorised Push Payment Fraud. This set out its new reimbursement requirement for authorised push payment fraud within Faster Payments. The reimbursement requirement is supported by 10 key policies.

- The Bank, as the operator of the CHAPS payment system, is committed to achieving comparable outcomes of consumer protection for retail CHAPS payments while also reflecting the unique characteristics of CHAPS as a wholesale payment system. We are working with the Payment Systems Regulator and CHAPS Direct Participants, as well as other key stakeholders, to deliver this. Our approach will be through a combination of directions from the PSR to CHAPS participants as well as changes to the CHAPS rulebook. The Payment Systems Regulator has indicated it expects to consult on a direction over CHAPS participants in Q1 2024.

- The model for CHAPS will cover participants who process CHAPS payments for UK retail use, and will include an upper limit for the value of reimbursement claims. On 19 December, the Payment Systems Regulator published Fighting authorised push payment scams: final decision. This confirmed that a maximum reimbursement level of £415,000 per claim will be applied for authorised push payment scams occurring over Faster Payments. For consistency, the Bank will apply a maximum reimbursement level of £415,000 per claim for UK retail CHAPS payments as well. The Payment Systems Regulator has said it will monitor the incidence and impact of high value scams and may review the reimbursement level ahead of October 2024 (the implementation date) if there is convincing evidence to do so.

- In 2015, the Payment Systems Regulator found that indirect participants typically pay around £2 to £3 per CHAPS payment, with a maximum of £30. End-users typically pay between £25 and £30.

Engagement with CHAPS users

We undertake a range of layered engagement and communication with CHAPS users. This covers financial institutions with direct and indirect access to CHAPS as well as end-users.

Strategic Advisory Forum

We host a Strategic Advisory Forum. This is a small focused group to discuss, and provide feedback and advice on, the strategic direction of RTGS and CHAPS with the Bank. It is chaired by Kevin Brown, one of the independent members of the RTGS/CHAPS Board and meets around 4 times a year.

The Forum’s external members are senior, experienced executives with a good understanding of the broad interests of their sector. The members are drawn from banks, other financial institutions, payment service providers and end-users. However, membership is in an individual capacity, not as a direct representative of their respective organisations.

-

- CHAPS Strategic Advisory Forum - 25 January 2019 (PDF 0.1MB)

- CHAPS Strategic Advisory Forum - 8 October 2018 (PDF 0.1MB)

- CHAPS Strategic Advisory Forum - 5 July 2018 (PDF 0.1MB)

- CHAPS Strategic Advisory Forum - 23 April 2018 (PDF 0.2MB)

- Terms of reference for CHAPS Strategic Advisory Forum - July 2019 (PDF 0.1MB)

Communicating with users

We are committed to giving appropriate voice to users in how we govern the CHAPS system. While the Strategic Advisory Forum has a vital role to play, we appreciate there is a large and diverse population of stakeholders with different interests.

We will communicate with CHAPS users through a layered approach. Some communication will come directly from us. Communication will include two-way engagement for us to seek views from, and respond to, users. In some instances, we will engage through other organisations, such as trade associations, to effectively reach a wider population.

Responsibility for the CHAPS system transferred to the Bank of England in November 2017. Board minutes from the CHAPS Clearing Company (the previous operator) are available through The National Archives.

CHAPS statistics

Last month

- In June 2024, CHAPS processed 4.1 million payments worth £7.3 trillion over 20 settlement processing days.

- The daily volume was 204,503, an increase of 2.2% from June 2023.

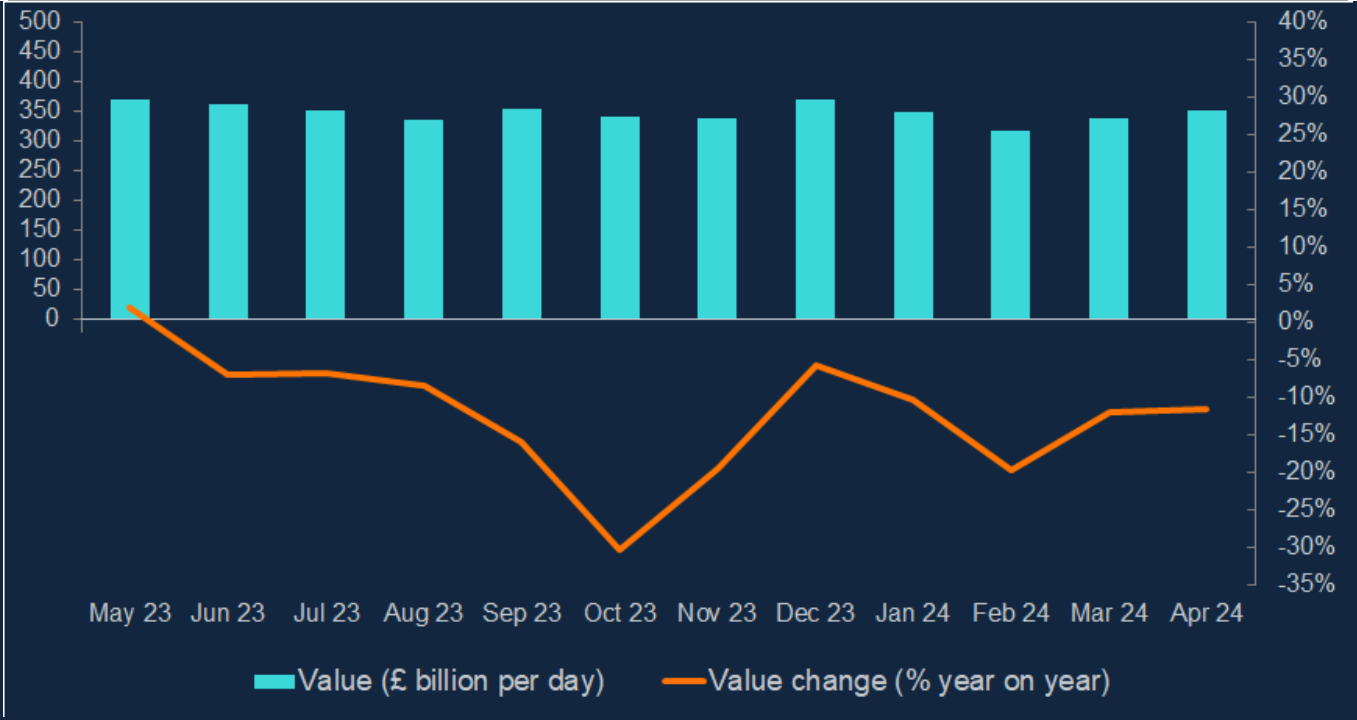

- The daily value was £363 billion, an increase of 0.5% from June 2023.

First half of 2024

- In the first six months of 2024, the average daily volume was 206,717, an increase of 0.9% from January - June 2023.

- In the first six months of 2024, the average daily value was £343 billion, a decrease of 10.0% from January - June 2023.

Last year

- In 2023, CHAPS volumes grew by 0.5% to a record 51.1 million; on average 203,759 per day.

- This surpassed the previous CHAPS volume record in 2022 of 50.9 million.

- The total value settled in CHAPS in the 12 months to December 2023 declined by 7.3% to £91.5 trillion; on average £364.4 billion daily.

CHAPS record days

- Volumes: Tuesday 2 April 2024, the first working day of the month, following a double Easter bank holiday, was an all-time peak volume day in CHAPS. The new volume record is 344,099, beating the previous record of 342,604 set on 28 March 2024.

- Values: Monday 3 October 2022 was an all-time peak value day in CHAPS. The new value record is £642.7bn, beating the previous record of £602.2bn set on the previous day, 30 September 2022. Prior to that, the record had been £542.3bn, set on 31 January 2022.

CHAPS in context

- CHAPS represents 0.5% of UK total payment volumes but 92% of total sterling payment values (excluding internalised flows within payment service providers).

- CHAPS turns over the annual UK GDP every 6 working days.

Market effects

- CHAPS volumes have more than recovered from 2020 levels, in line with economic recovery from the initial Covid outbreak.

- Volumes have also grown as the property market recovered from deep decline in mid-2020. Notably during 2021, activity was brought forward into the months of March, June and September, ahead of Stamp Duty holiday deadlines.

- The record volume day on 30 September 2022 largely reflected general growth in CHAPS use. This was expected to be a double peak day in CHAPS. The last Friday of the month is popular for property completions and the last day of the quarter is important for business and financial payments. There was only a minor contribution to volumes from high value transfers arising from active financial markets.

- Most of CHAPS value (73% in 2021) is in wholesale financial transactions and is therefore largely reflective of financial market conditions.

- CHAPS values rose particularly during the early stages of the pandemic. Although many financial market settlements were on other financial market infrastructures (FMIs, i.e. non CHAPS) or in different currencies, net sterling flows to and from FMIs that were made over CHAPS grew substantially. The total value of short-term lending (money markets) payments in CHAPS was also considerably higher in 2020.

- CHAPS values reverted towards 2019 levels in 2021. Value decline in 2021 was in both corporate (and other non-interbank) and in wholesale financial use, particularly in money markets.

- CHAPS values have increased again in 2022, reflecting active financial markets. In particular, active financial markets in the second half of September 2022 contributed to successive record CHAPS value days at the quarter end and the following start of month.

The two reports above (quarterly and annual UK payment system statistics) are reported on behalf of CHAPS and the other payment system operators by the Data and Analytics team at Pay.UK. Please contact them by email data@wearepay.uk for monthly statistics, previous reports or with other queries about these reports.

For enquiries about CHAPS statistics: please contact the Bank of England press office on 020 3461 4411 or by email press@bankofengland.co.uk.

CHAPS Volumes for the previous 12 months

CHAPS Values for the previous 12 months