By Kieran Dent, Ben Westwood and Miguel Segoviano

The usage and prominence of bank stress tests has risen substantially in the years following the global financial crisis. They are now established as a key part of the bank regulation toolkit.

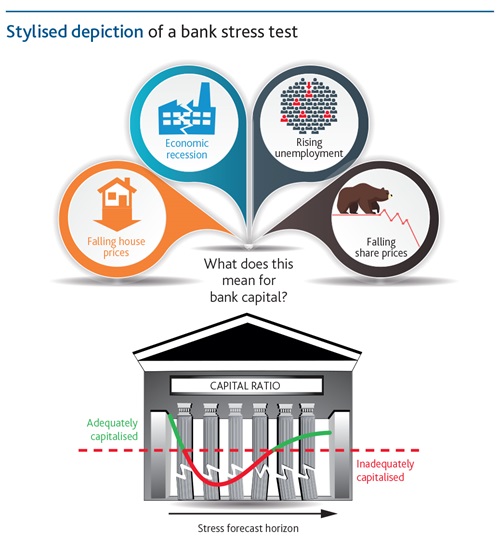

Typically, bank stress tests measure the resilience of banks to hypothetical adverse scenarios like severe recessions, with results used by central banks and regulators to measure risks and manage them through the setting of prudential policy.

Over time, to enhance their usefulness to policymakers, stress tests are likely to develop further, for example by testing banks against a wider range of resilience metrics than capital, and further exploring how stresses might be transmitted across the financial system (eg through contagion).